67%

Growth in Land Value

(Since 2020)

44%

Projected Minimum Growth

in the Next 5 Years

168

Build-ready

Plots Available

Our Developments

PURCHASE AGREED

Luxury Golf Resort

- 130 plots

- Zoned & approved for development

- Price from $75,000

COMING SOON

Luxury Oceanfront Plots.

- 28 plots

- Zoned & approved for development

- Price from $149,000

How it Works

Primefield identify, assess and target undervalued land (Land already zoned/approved for construction).

Due diligence is conducted by professionals i.e. legal representatives and in-house real estate team.

Upon successful due diligence, land is acquired and held in the Primefield portfolio.

Create subdivision plan and design lot sizes and support infrastructure.

Our in-house team registers individual lots (New PID’s) with Land Registry and local municipality.

Sell the ‘Shovel-Ready’ lots to domestic and international buyers aiming to achieve a high return on investment.

Primefield identify, assess and target undervalued land (Land already zoned/approved for construction).

Due diligence is conducted by professionals i.e. legal representatives and in-house real estate team.

Upon successful due diligence, land is acquired and held in the Primefield portfolio.

Create subdivision plan and design lot sizes and support infrastructure.

Our in-house team registers individual lots (New PID’s) with Land Registry and local municipality.

Sell the ‘Shovel-Ready’ lots to domestic and international buyers aiming to achieve a high return on investment.

About us

Primefield are strategic land specialists in Canada.

A land acquisition and development company that maximises the value of undervalued land, operating predominatly in the commercial sector. We acquire and develop assets that deliver high returns over time, retaining their value long-term, even during times of economic instability. Our aim is to create long-lasting and sustainable wealth. We have a broad portfolio of international projects across the residential and hospitality sectors.

Our People

A combined 75 years’ experience in the field.

Nick Goldsworthy

Nick began his career in Estate Agency, Property, and Financial Services in the 1980s and now brings over 39 years of experience in property sales, lettings, investment, development consultancy, and mortgage and financial services. Over the course of his career, he has developed an extensive understanding of both the corporate property world and the dynamics of private investment, combining strategic insight with hands-on market expertise.

For the past 25 years, Nick has successfully operated his own property investment business and estate agency alongside his long-standing business partner, Andy Ferguson. Together, they have built an enviable reputation for professionalism, integrity, and consistently delivering results. Their advice is sought after by a broad spectrum of clients — from private investors and home movers to major UK and European developers and corporations.

Over the last 24 years, Nick and Andy have handled numerous residential and commercial investment property transactions across the United Kingdom, with a strong focus on the Northern region. Their portfolio of work spans everything from individual buy-to-let investments and family homes to large-scale apartment blocks and landmark development projects.

Their experience includes the successful marketing and sale of entire new-build developments — such as over 100 apartments in the North West — as well as prestigious Victorian conversions in sought-after locations. They have also provided strategic consultancy to major UK and European landowners and developers on several of the region’s most unique and high-profile schemes.

Among their standout achievements is their involvement in the transformation of two floors of a Tower Building in Merseyside, converting redundant office space into approximately 40 luxury apartments overlooking the Iconic Liver Building, all of which were successfully sold to European and Far Eastern investors at full market value.

Nick and Andy were also instrumental in the success of Liverpool’s landmark Tobacco Warehouse redevelopment at Stanley Dock — the largest warehouse conversion project in the UK. From initial planning consultancy through to open-market launch and final sales, they played a pivotal role in bringing this extraordinary scheme to life. The first phase alone comprised 186 duplex apartments, with a gross development value of approximately £75 million. Virtually all units — averaging £360,000 to £400,000 each — were sold, setting unprecedented benchmarks for both pricing and absorption rates within Liverpool’s city centre market.

Throughout his career, Nick’s unwavering dedication, deep market knowledge, and client-first approach have established him as one of the most respected professionals in the North West property sector. His ability to combine detailed financial understanding with long-term strategic vision continues to drive successful outcomes for his clients and partners alike.

Read More

John Dicks

John began his career in real estate in 1982 and has been involved in numerous property development and apartment construction projects. He has also owned and operated businesses across various sectors, including environmental technology, cinema technology, and international business consulting. A dedicated supporter of both local and global non-governmental organisations (NGOs), John founded and served as Executive Director of the first NGO to operate in Central and Eastern Europe promoting market economies and civil society in the fall of 1990.

Andy Ferguson

Andy began his career in Estate Agency, Property and Financial Services in 1999 and now has over 26 years’ experience in Property sales, Lettings, Investment, Development consultancy and Mortgage and Financial Services. He has gained a vast amount of experience, both working in the corporate world and then over the last 24 years running his own property investment business and Estate Agency with his business partner Nick Goldsworthy.

Why Invest in Canada

Residency Visas & Citizenship

There are unique pathways for investors to gain permanent residency and citizenship.

Low Corporation & Income Tax

Canada offers one of the lowest federal government corporate tax rates in the G7.

Stable Jurisdiction & Economy

Canada is recognised around the world for its stable, open business environment and strong economy.

Undervalued Land Prices

Nova Scotia, in particular, has some of the most affordable land per acre in Canada, with other regions offering land with huge development potential at a low price.

World-Class Amenities

Access to exceptional healthcare, education, and transport systems. City living is intertwined with stunning nature. Canada offers a high quality of life.

Government Incentives for Developing Land

The Government of Canada offers several incentives, including funds, loans, rebates, and tax breaks, to encourage land development.

Is Canada the World’s Best Kept Secret

Canada offers residents a high quality of life. They have access to world-class universal healthcare and education, and has a strong, stable economy with a robust banking system and excellent job market, which offers higher than average income, compared to the UK, for example. The country is known for its low crime rates, strong sense of community, and political stability, making it a safe place to live for individuals, couples, families, and retirees.

Canada has a diverse landscape and spectacular scenery, from bustling cities to natural landscapes featuring mountains, forests, harbours, and more. Compared to other more densely populated countries, Canada offers a greater sense of space and better access to nature, even in urban centres. It’s not hard to see why Canada is a prime location for investors and expats.

Become a Partner

Interested in working with us? Fill out the below form to learn more.

News

Stay up-to-date with all the news in the field.

FAQ

Primefield acquires lucrative land assets in Nova Scotia, at an undervalue with scope of development and subsequent sales thereafter – this may also include refinancing land once its acquired following value-add.

Your investment is secured by way of shareholding in the company that will hold the land assets. If the company sells the land assets, the company will retain the sale proceeds. The shareholding is subject to the terms and conditions of the share agreement.

Yes, you can sell your shares to third parties which meet the requirements of the securities legislation in Nova Scotia, Canada.

You can redeem your shares at the end of the two year minimum term.

Primefield aims to acquire and develop assets which provide a minimum gross return of 40%, enabling the company to afford an annual dividend rate of 9% to its shareholders.

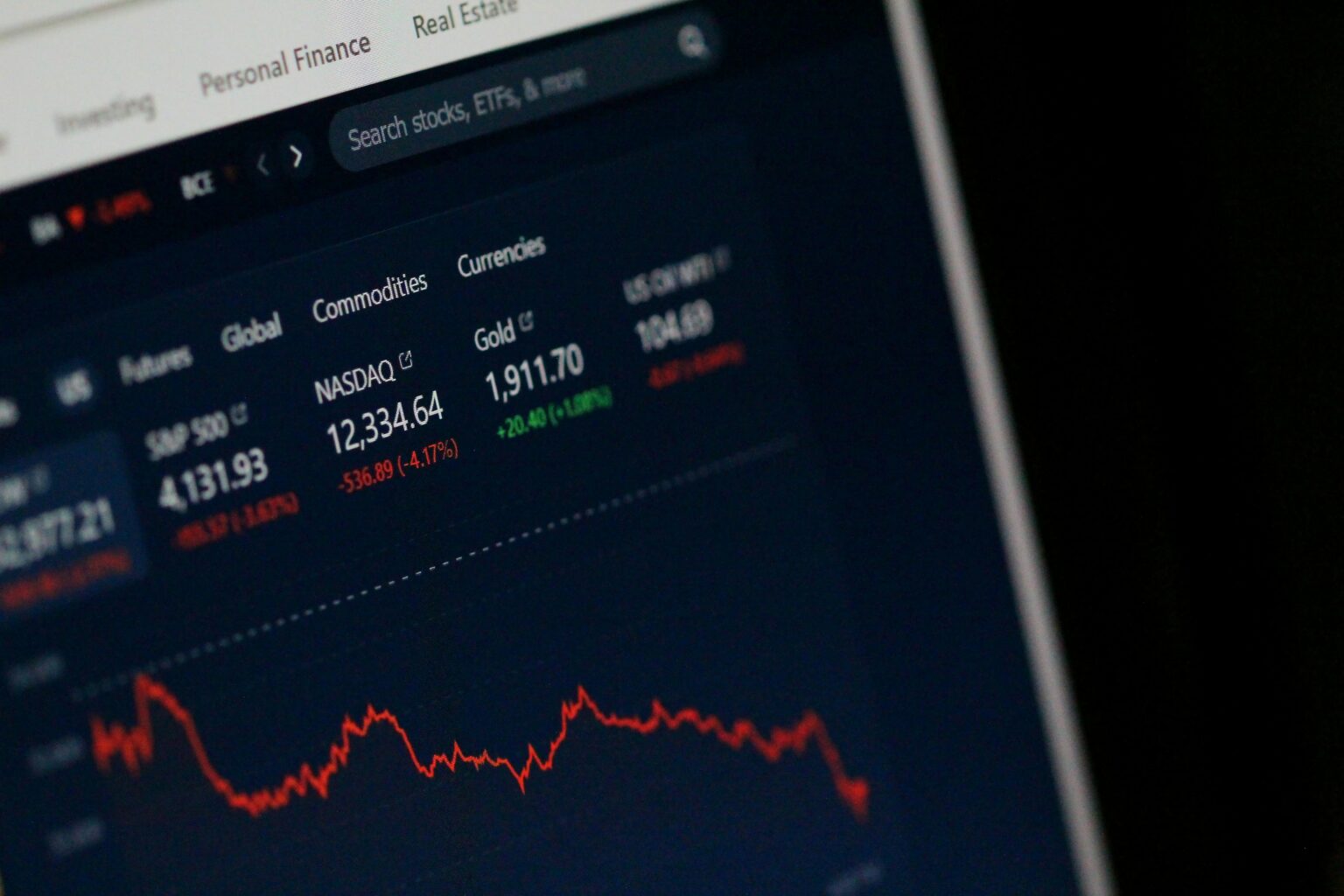

Land in Nova Scotia has seen 67% growth since 2020, and outperforms most real estate markets internationally – especially during times of economic uncertainty. In addition to this, rental demand is increasing year on year, as Nova Scotia continues to increase its population by way of domestic and international immigration.

You can subscribe by requesting an application form, from Primefield directly or your introducer. Once you have completed the application form, your application will undergo internal due diligence. Once this has been completed, a share agreement will be issued to you for signing, before you fund your subscription.

The minimum subscription amount is $150,000.00 Canadian Dollars, or equivalent in other currencies. This is a requirement under Nova Scotia securities legislation.

Canada is one of the most politically and economically stable countries, and has become attractive over recent years given the instability in other parts of the world. The Nova Scotia Real Estate market provides even further insulation to investors, looking to safeguard and protect their portfolio overall in times of economic downturn.